Want to make your coaching business more profitable? In this guide, we share the ins and out of improving cash flow and profitability.

The solopreneur or consultant / coach model can be great for lifestyle, but it can be hard to scale that business model to create financial freedom.

However, if there is a plan in place to take the money earned as a coach/consultant, manage living costs and then invest in cash-flow producing assets then financial independence would still be possible.

Want to know the secret to building a financially successful coaching business? Bookkeeping! (Yes, we’re being serious.)

Now before you start assuming things and clicking over to a new site, we urge you (for your own benefit) to put your curiosity cap on and stick around.

In this guide, we’ll go over everything coaches need to know about using bookkeeping to create a financially healthy coaching business.

- Risks for Coaching Businesses That Neglect Their Bookkeeping

- What Do Financially Healthy Coaching Businesses Look Like?

- What Top Coaching and Consulting Businesses Do To Be Successful

- Bookkeeping – The Secret to Building a Profitable Coaching Business

- Improving Cash Flow In Your Coaching Business

- Getting Paid for Your Coaching Services

- Expenses

- Accounting Software

- Paying Team Members

- Reporting

- Coaching and Consulting Business Structure

- Paying Taxes

- Cash vs Accrual Accounting

- Hiring a Bookkeeper for your Coaching Business

- Practical Coaching Business Tips from Successful Coaches

- Next Steps for Improving the Financial Health of Your Coaching Business

BONUS: Want a quick and simple way to work out your business’ financial health? We’ve created a Xero Small Business toolkit for you to use (includes cash flow forecast template and tutorial videos). Grab it here.

Reality check – in today’s fast-moving world, many coaches (and consultants) are struggling to earn enough money from their coaching business to survive.

Here are some of the things that we’ve heard coaches and consultants say…

“I worry about paying my bills every week”

“I’m not sure how many more months the business can continue to operate for”

“I want to hire someone to help free up my time, but I’m not sure if I can afford it”

“I’m not paying myself a regular weekly wage”

“I’m not sure what portion of the money in my bank account is profit”

Any of this sound familiar?

If it does, then you’re certainly not alone.

We get it.

As a coach who has escaped the corporate world to create a freedom lifestyle and business, you want to spend your days selling and delivering your service, creating content, and helping people better themselves. You don’t want to spend time worrying about arduous tasks like bookkeeping.

Perhaps you’re already doing things like KPI tracking with a data entry support person.

Maybe you’re still unclear about when to use a bookkeeper over a data entry person. That’s ok. This guide will help you decide.

Whatever your current situation, if you’re serious about improving the financial health of your coaching business, then bookkeeping is important.

To illustrate this point, let’s consider the potential impacts of not paying attention to your books.

Coaches, are you neglecting your bookkeeping? Well, you might want to read this guide (It just might save your business!) Click To TweetArticle Contents

- 1. Risks for Coaching Businesses That Neglect Their Bookkeeping

- 2. What Do Financially Healthy Coaching Businesses Look Like?

- 3. What Top Coaching and Consulting Businesses Do To Be Successful

- 4. Bookkeeping – The Secret to Building a Profitable Coaching Business

- 5. Improving Cash Flow In Your Coaching Business

- 6. Getting Paid for Your Coaching Services

- 7. Expenses

- 15. Practical Coaching Business Tips from Successful Coaches

- 16. Next Steps for Improving the Financial Health of Your Coaching Business

1. Risks for Coaching Businesses That Neglect Their Bookkeeping

What happens if you neglect your bookkeeping?

Well, you could lose money, make errors, and starve yourself of the information you need to make smart decisions.

Worst case scenario?

Well, it’s either going to be…

a) a failed business,

b) having to go back to a regular J-O-B, or

c) not making the massive impact you set out to make when you started.

Which would be more painful for you?

Neglecting bookkeeping = make bad decisions + lose money. Don't want that to be you? Read this guide to improving the financial health of your coaching business. Click To TweetThis is why we put together this bookkeeping guide for coaches (by the way, if you’re a consultant this will help you too).

FREE BONUS: Want a quick and simple way to work out your business’ financial health? We’ve created a Xero Small Business toolkit for you to use (includes cash flow forecast template and tutorial videos). Grab it here.

2. What Do Financially Healthy Coaching Businesses Look Like?

In our experience, there are a few stages of financially healthy businesses:

1. Is having enough money in the bank to not worry about paying the bills (this could be 3+ months of runway)

2. Having an accounting system that makes it easy to process data. For example, leveraging technology like Xero and Hubdoc / Receipt Bank to automate most of the collection of data.

3. Having reports that are meaningful and accurate. This would involve having a Chart of Accounts that is customized to your business & KPIs and a review process to make sure the data entry is accurate.

4. Once your system of collecting data is working well and you are receiving accurate reports you need to have the financial literacy to make good decisions based on the data.

5. Next, you would have a cash-flow forecast and a budget. The cash-flow forecast gives you comfort about paying the bills and predicting how much money will be in your bank account in the future.

The budget helps you track progress against profit goals.

We haven’t covered tax here, but a financially healthy business would also have received tax advice on how to structure their business effectively to reduce tax and protect assets. This would be reviewed at least annually as part of a tax planning session.

What Do Financially Healthy Coaching Businesses Look Like? That depends on what stage your business is in. Learn more. Click To Tweet3. What Top Coaching and Consulting Businesses Do To Be Successful

At Bean Ninjas, we have grown alongside a number of successful coaches.

We’ve observed that those who are most successful, have done so by:

- Repeatedly delivering solid results to their clients

- Leveraging client wins to generate highly-qualified referrals

- Effectively sharing their success stories through targeted marketing

Those efforts require considerable investment in both time and finances.

If you don’t control them carefully, you’ll run out of runway before ever getting your business off the ground.

You’ll waste money on low ROI expenditures.

Maybe even price your services inefficiently.

We want you to be one of those successful and profitable coaches.

This guide to bookkeeping will help you with that.

4. Bookkeeping – The Secret to Building a Profitable Coaching Business

With healthy books, you’ll:

- Have the tools to make your business lean, efficient, and growth-focused,

- Have clean data to make great decisions,

- Stay tax compliant, which takes a lot of stress out of your life.

Fortunately, coaches don’t usually have extensive bookkeeping needs (as compared to, industries like manufacturing, importing, or retail).

Having said that, it’s still a critical part of being successful and growing quickly.

Key Metrics for Top Coaching Businesses and Consultants

When it comes to running or growing a business, you need good data to make impactful decisions. Without information, you won’t know which levers to push to steer your business.

Solid bookkeeping turns raw data into meaningful metrics that help you make decisions. Here are the key metrics bookkeeping can help you track:

- Monthly Recurring Revenue – applicable if you have ongoing monthly coaching fees

- Profitability of done-for-you and/or done-with-you type products or services

- Customer Lifetime Value (LTV) – tells you how much revenue you can expect one customer to generate over the course of the business relationship.

Imagine, for instance, that you didn’t know the lifetime value of a customer it would be difficult to work out how much to spend on acquiring customers.

In that case, there’s a chance you could overspend on marketing and end up losing money for each customer you acquire. Obviously, that’s counterproductive.

Furthermore, you can’t grow what you don’t track. You need to compare a starting value with an ending value to determine whether your actions had an effect.

In the early stages of your business, you can mentally track your metrics because they’re few and simple. But as your coaching business grows, you’ll need to use bookkeeping to organize your data in meaningful numbers like the ones we listed above.

Related: Our Journey to $100k in revenue in just 8 months

5. Improving Cash Flow In Your Coaching Business

There are many ways to improve cash flow, so let’s take a look at some of the strategies that have been working for our clients.

Add Strategies To Attract New Clients as part of your Coaching Business Plan

Whilst writing a 60-page business plan probably isn’t the best use of your time, having some kind of strategic plan and understanding your business model can be very useful for identifying opportunities to improve your cash position.

Some questions to get you thinking:

- Who are your best and most profitable clients? What about the least profitable ones?

- How can you add or test complimentary products or services to increase Customer Lifetime Value (LTV)? Or remove or tweak underperforming ones?

- What’s your marketing, lead generation, and sales strategy? What’s been working for you in the last 90 days? What hasn’t?

- Are there any sales and marketing tasks that you could outsource? Like creating high-value case studies that demonstrate your business can deliver?

- Are there other funding avenues that you haven’t considered?

- How can you wow your current coaching clients better so that they stick around longer and/or refer more clients to you?

- Are you effectively leveraging strategic partnerships as a channel for attracting new business?

Recommended tool: Create a new business model canvas

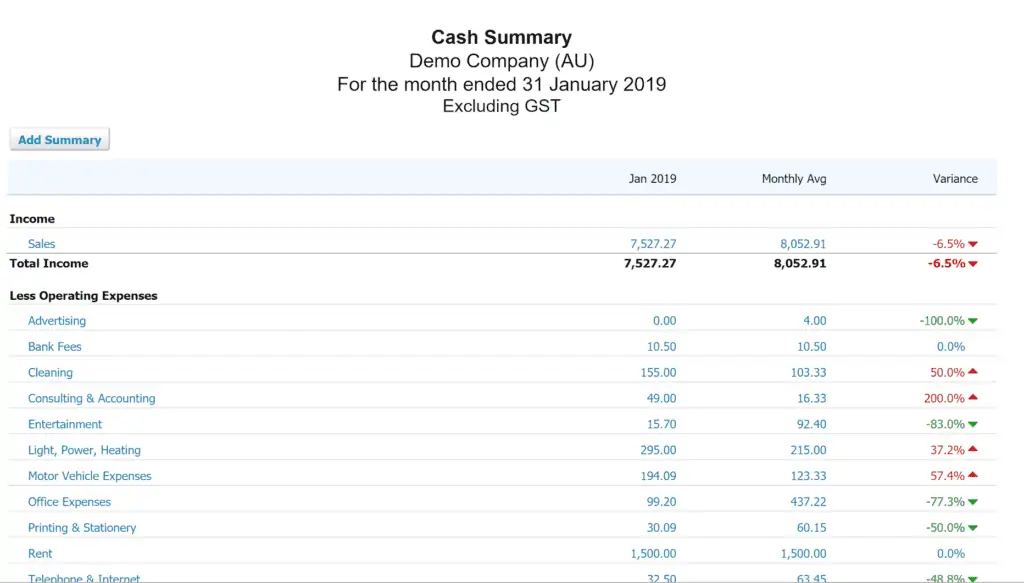

Review your cash flow statement (cash summary) regularly

What you focus on expands. So if you want your cash flow to improve, then you’ll need to keep a regular eye on how your cash is moving.

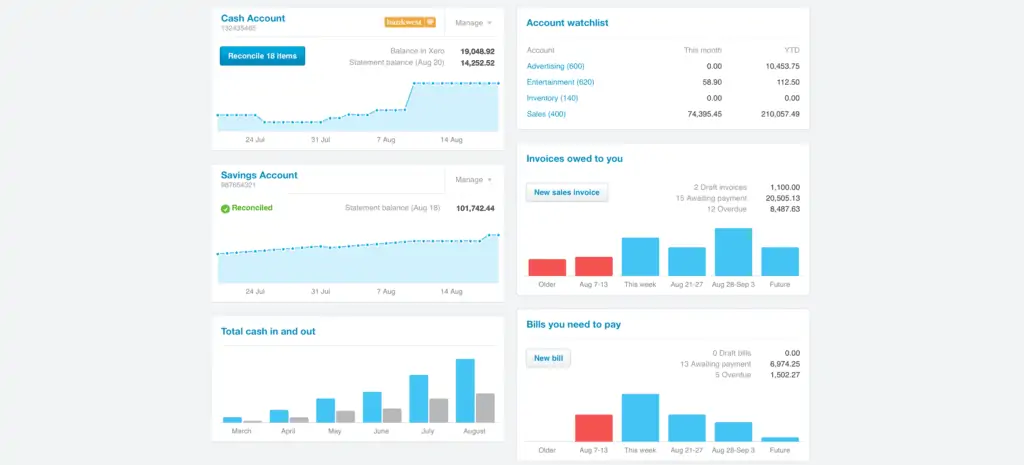

Fortunately, accounting software like Xero makes generating cash flow statements and reporting very easy. Here’s an example of a cash summary:

We’ll discuss additional types of reports available later on in this guide.

Prepare regular cash flow forecasts using a cash flow forecast template

The cash flow forecast is one of the most important financial documents for coaching or consulting businesses.

Unfortunately, it’s also one of the reports business owners tend to ignore.

A cash flow forecast estimates the amount of money you expect to flow in and out of your business every week, month, or even a year.

It’s particularly useful when you foresee a cash shortage coming up, so you can apply corrective action before it’s too late.

You can build your own simple cash flow forecast template using a spreadsheet, or you can save yourself some time and use our free cash flow forecast template.

Reduce business operating expenses

Do you really need to be paying for most expensive customer relationship (CRM) software, or will a simple spreadsheet do the trick?

What about all those online courses and training that you’ve paid for that you’ve never even looked at?

We get it. Seriously, we’ve been there too.

It’s easy to get caught up in the latest technology and shiny objects. But failure to stay on top of your monthly spending can spell doom for your business.

Don’t assume that you can just write it all off as a tax deduction either. What if your business goes under before you get a chance to claim those expenses back on tax? Ouch.

Related Presentation: Pay yourself more by understanding your business finances

6. Getting Paid for Your Coaching Services

Naturally, getting paid is one of the most important parts of running a business, which is why we’ve included it early in this bookkeeping guide for coaches. If you want a successful business, you’ll need to make sure you’re paid accurately and timely.

It’s important to make it as easy as possible for your customers to pay you. If they have to jump through hoops to send you money, there’s a good chance it will fall to the bottom of their to-do list.

The simplest way to get paid is with a clear and easy to read invoice.

There are plenty of invoicing tools available. Here are some of the most popular tools:

No matter which tool you decide to use, you need it to do four things:

- Look professional

- Create and send invoices easily

- Let your customer pay easily through the invoice

- Integrate with your accounting tool

Those four features are so important that we recommend using accounting software that includes an invoicing function.

Your customers should be able to click a “pay” link in the invoice to send a payment, and that payment should be recorded right straight in your accounting software.

Xero is our favorite tool. We recommend it to everyone.

Here’s a quick video demonstrating how to create an invoice for a customer in Xero:

Related reading: Comparing Small Business Accounting Tools: Xero v Quickbooks v Freshbooks v MYOB.

Payment Processors

Once you have a way to send invoices, you’ll need an account with a payment processor like Stripe, Square, or PayPal. These services let you process credit cards.

They’ll charge a fee, of course, but it’s part of doing business. Your accounting software and payment processor should integrate together.

If you run a membership site or intend to charge for repeated services, you’ll also have to make sure your payment processor lets you charge recurring billing.

If you use a course content system like Kajabi, Thinkific, or Teachable, the platform will either deposit earnings directly in your account or through a payment processor.

Related Reading: Avoid Stripe and Xero headaches: Step by Step Guide

Billing up Front

Consider advance payments: Coaching is built on respect, trust, and mutual accountability. If a client does not pay you or pays late, it’s a sign that one of these areas is lacking.

Consider billing up front based on an agreed upon scope of service. By doing so, you’ve ensured you’ll be covered for the time you spend on agreed upon services while also maintaining a position to charge for “extra” hand-holding or uncharged work.

Chasing Late Payments

If you can’t bill upfront then make sure to stay on top of your accounts receivable. If you let your clients get away with late payments (or worse, failing to pay), your cash flow and growth will suffer. Use the tools in your account software to monitor unpaid invoices.

In this short video, we share how to quickly work out in Xero who owes you money (as well as some other tips):

Follow up on late invoices. You may want to charge a fee for late payments. Too scared to ask for a late payment? Read these helpful tips.

7. Expenses

As an online coaching business, you won’t have as many expenses as a manufacturing or retail business. But you’ll still have some, so your bookkeeping should account for them. Identifying, calculating, and analyzing your expenses is the only way to minimize them.

Poor expense management almost always creates cash flow problems. Without healthy cash flow, you’ll struggle to pay your operational costs and you’ll lack money to invest in growth.

Sometimes it’s better to hire someone else to manage your books for you. Click To TweetThe bookkeeper’s role is to manage your day-to-day transactions within your accounting software. They’ll make sure each item is categorized properly in your chart of accounts.

If your payments and expenses aren’t organized accurately, it will create a ripple effect that will disrupt all of your finances.

You can also request that your bookkeeper works directly with your tax accountant, to reduce the time you need to spend on accounting tasks.

Bookkeeping is actually one of the most common services companies outsource. So when you are next doing your own bookkeeping think about whether this time would be better spent on growing your business.

Related reading: 10 Questions to Ask Before You Hire a Bookkeeper

Accountant vs Bookkeeper – Who Should I Be Working With, and When?

This video gives a great explanation of when to work with an accountant:

The bookkeeper’s role is to handle the day to day transactions in the accounting software and to make sure that each item is allocated correctly to the right account in the chart of accounts.

Want to know who else you’ll need on your accounting team at each stage of business growth? Read this post.

At Bean Ninjas, we specialize in bookkeeping for online businesses including coaching and consulting businesses. If have any questions about Xero or bookkeeping feel free to get in touch.

Related reading: Working with a Bookkeeper: How to Get the Most Value Out of Your Bookkeeper

Looking to hire a bookkeeper for your Coaching Business? Read this guide first. Click To Tweet15. Practical Coaching Business Tips from Successful Coaches

Mandi Ellefson, Growth Strategist:

“1. The best way to increase profits in your business when you offer high-level services like consulting is to increase your fees. You do that by looking for bigger problems to solve so that you can provide more value. Then clients will happily pay more.

2. An easy way to increase cash flow is to always get paid upfront for your services. Otherwise, you have to cover the costs in your business before you get paid which is risky.”

Michaela Light, Intuitive Leadership Coach:

“Ask your intuition to give you signs to help make a decision or to confirm you have made the right decision. Ask yourself ‘WWIT (What Would It Take) to know the ideal decision for me to solve this problem?'”

Paul Higgins, Coach:

“From running a coaching practice for the last seven years and mentoring other coaches, the key way to improve your cash flow and reduce admin expenses is to have clients set-up on a recurring monthly payment. We use thrivecart. It makes it easy to have direct debit payments and reduces unnecessary admin and awkward follow-up conversations which can impact a relationship.

You can also set-up a discount and set-up a sequence for the forms you set up and it will automatically integrate with your preferred payment gateway (ours is stripe) and CRM.”

Angela Henderson, Business Consultant:

“1. Open a new business bank account.

2. Purchase an accounting software that is right for your business.

3. Allocate time each week to ensure your bookkeeping is up to scratch”

Willo Sana, Transformational Business Coach:

“Delegating is a fantastic way to save you time and move your business forward, but you’ll save way more time (and money!) when you are diligent about being specific with your requests.

Help your team succeed by giving them the proper attention and training they need. This will ensure they’re not just working for you, but that they’re working smart, efficiently, and it will increase the odds that everything will go swimmingly.”

Geoff Hetherington, Profitability Coach:

“It is all about profitability. Without the ability to sustainably make profits businesses go out of business. Profitability is more than cutting expenses or raising prices. It’s also about convenience.

A smart operator knows that the less friction involved in doing business with them, the more profit & sales made. If dealing with you is easy and convenient then customers tell others and come back. Convenience is sticky.”

16. Next Steps for Improving the Financial Health of Your Coaching Business

We just threw a lot of information at you, but bookkeeping is simpler than it seems. Hopefully, we’ve expressed that in this guide.

Key takeaway: If you want to be a serious business that runs smoothly and grows consistently, you must take bookkeeping seriously. Whether you do it yourself or hire someone to manage it.

At the least, we recommend that you start by creating a simple cash flow forecast. Use our free cashflow forecast template to make this step easier.

Once you invest in accounting software, learn how it works, and set up a simple workflow for you (and your team), bookkeeping won’t take up a big portion of your time. If you outsource everything to a bookkeeper, it will hardly take any time at all.

We hope this guide has prepared you for your journey to freedom!

If you have any questions please feel free to get in touch. We also offer 1-on-1 Xero Training sessions if you have some specific questions related to your business you’d like help with.

Want to improve your cash flow and get more confident with your numbers? Learn how to use Xero effectively for your e-commerce business with our free Xero toolkit. This includes our profit margin calculator, eCommerce annual forecast template, salary cap calculator, financial roadmapping template, and more. Download now.